GTA Real Estate Market Report – January 2026

2025 Was the Adjustment. 2026 Is the Test.

Happy New Year!

As we head into 2026, we hope the holidays offered some downtime and a chance to reset. After a long year of cautious decision-making, the market is entering the new year on steadier footing, with clearer signals around pricing, supply, and negotiation.

2025 closed with familiar conditions: 62,433 sales, down 11.2 percent year over year, while new listings rose to 186,753, up 10.1 percent. Prices adjusted accordingly, with the annual average selling price at $1,067,968, down 4.7 percent from 2024. Supply stayed elevated throughout the year, giving buyers more choice and more leverage than they’ve had in some time.

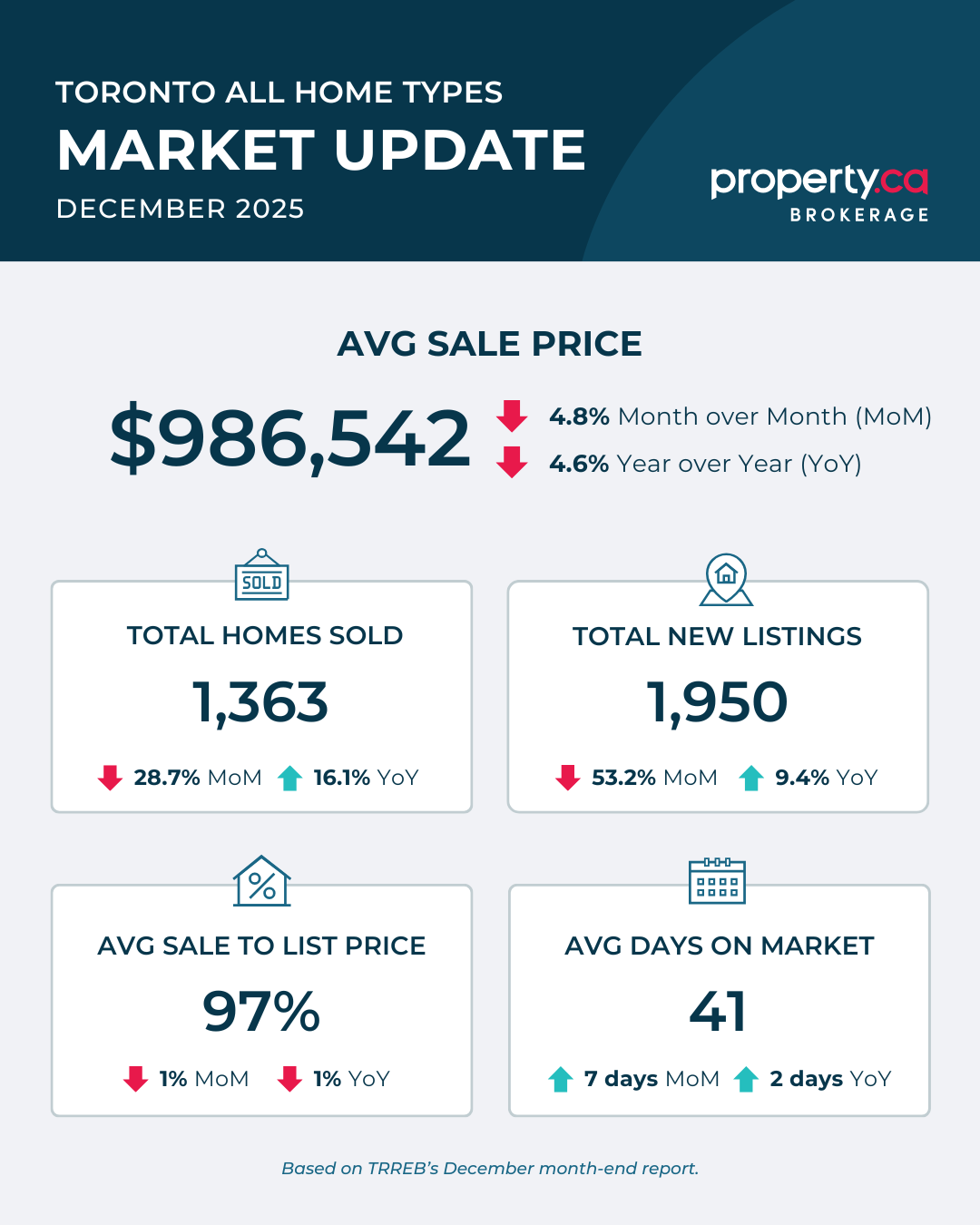

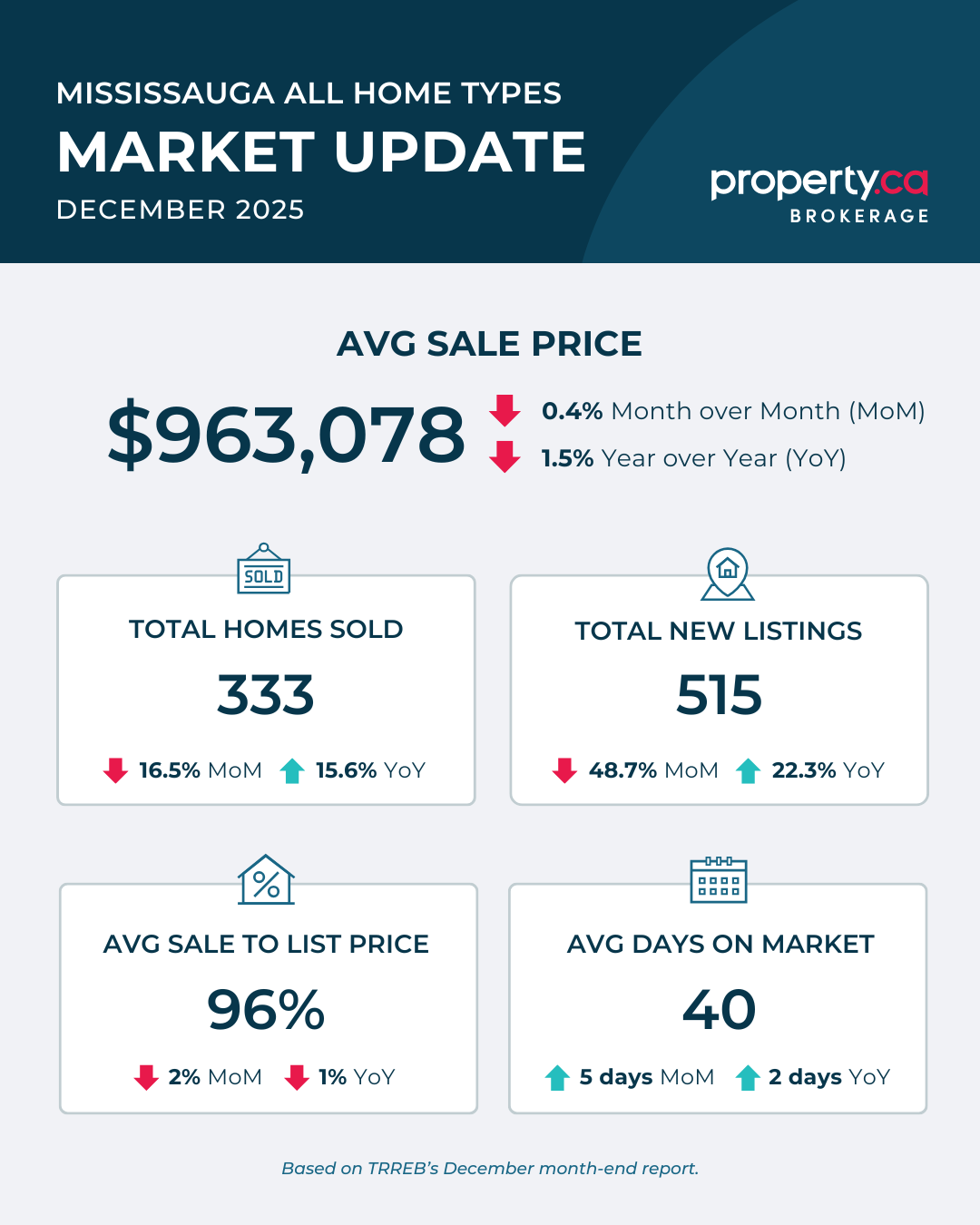

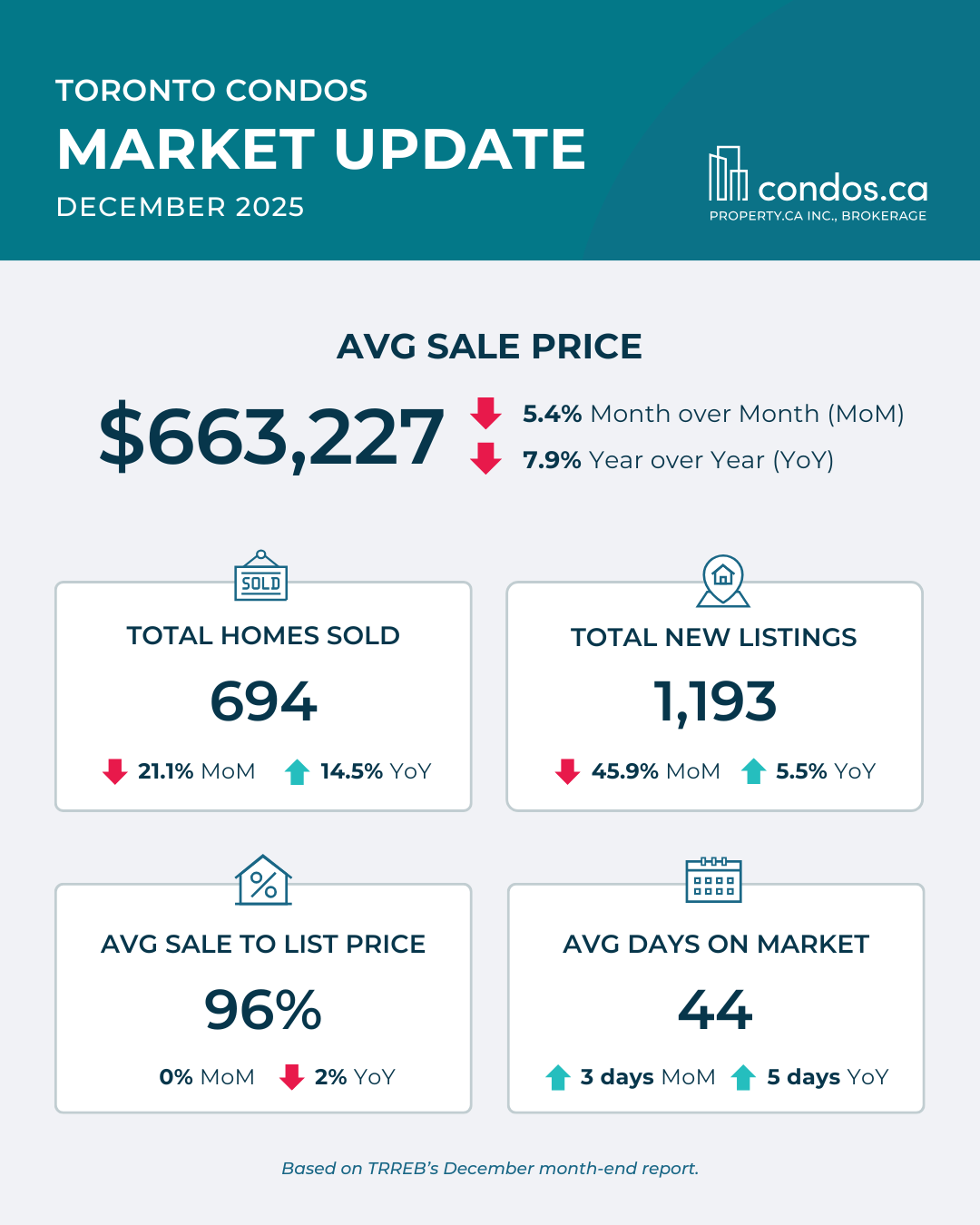

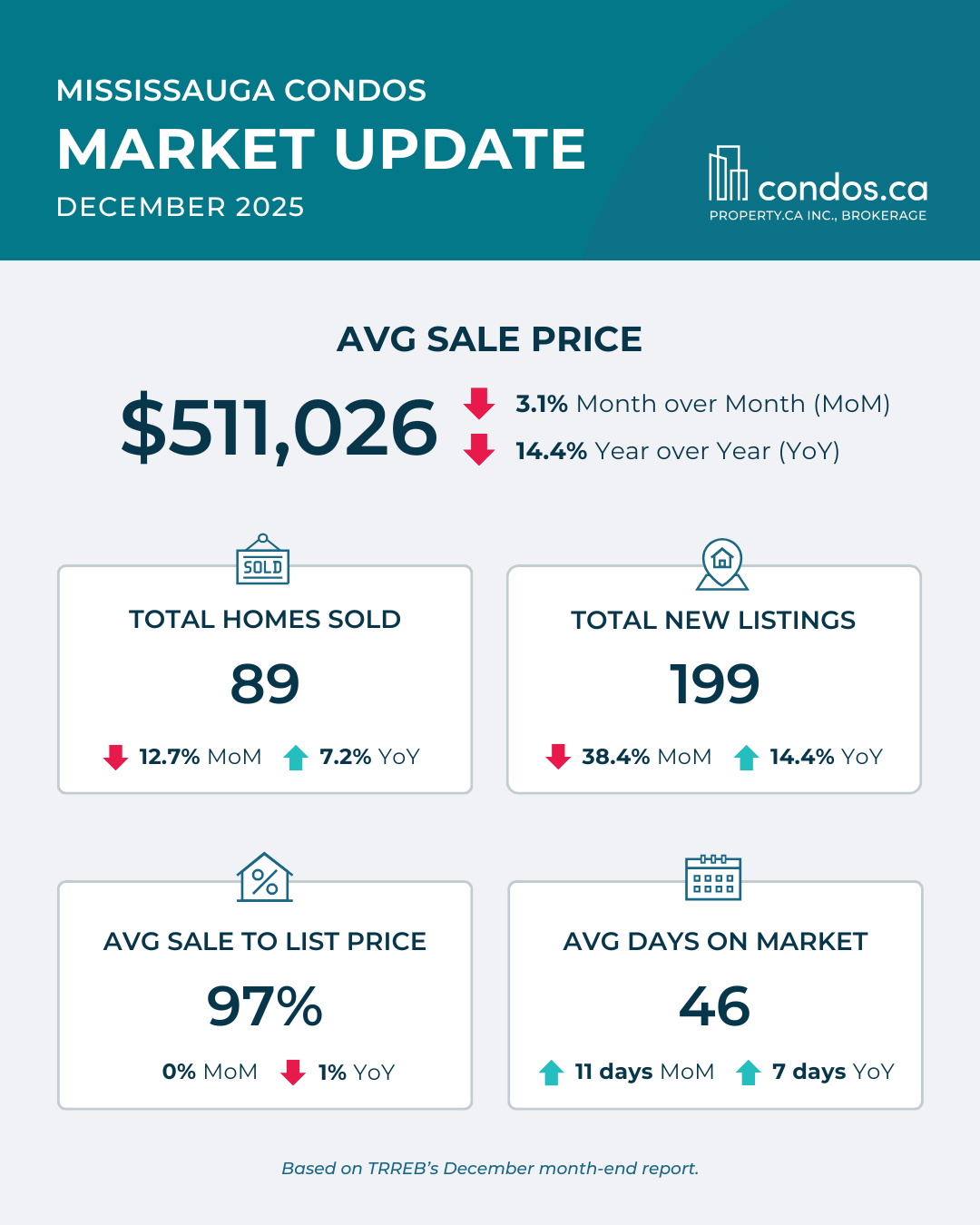

December activity followed the same pattern. Sales totaled 3,697, down 8.9 percent year over year, while new listings reached 5,299, up 1.8 percent. The MLS HPI Composite benchmark was down 6.3 percent year over year, and the average selling price came in at $1,006,735, a 5.1 percent annual decline. The market remained well supplied, and price sensitivity continued across most segments.

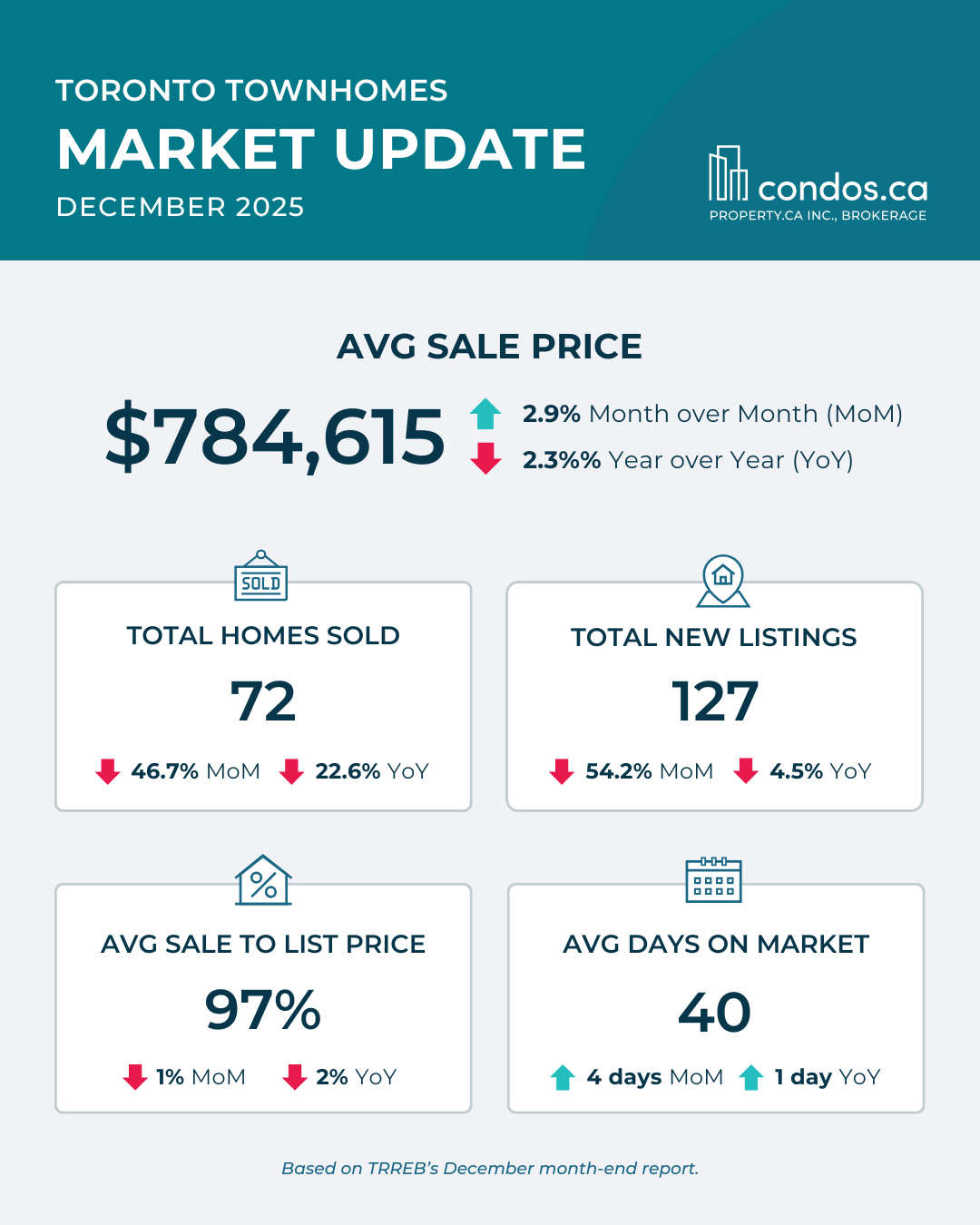

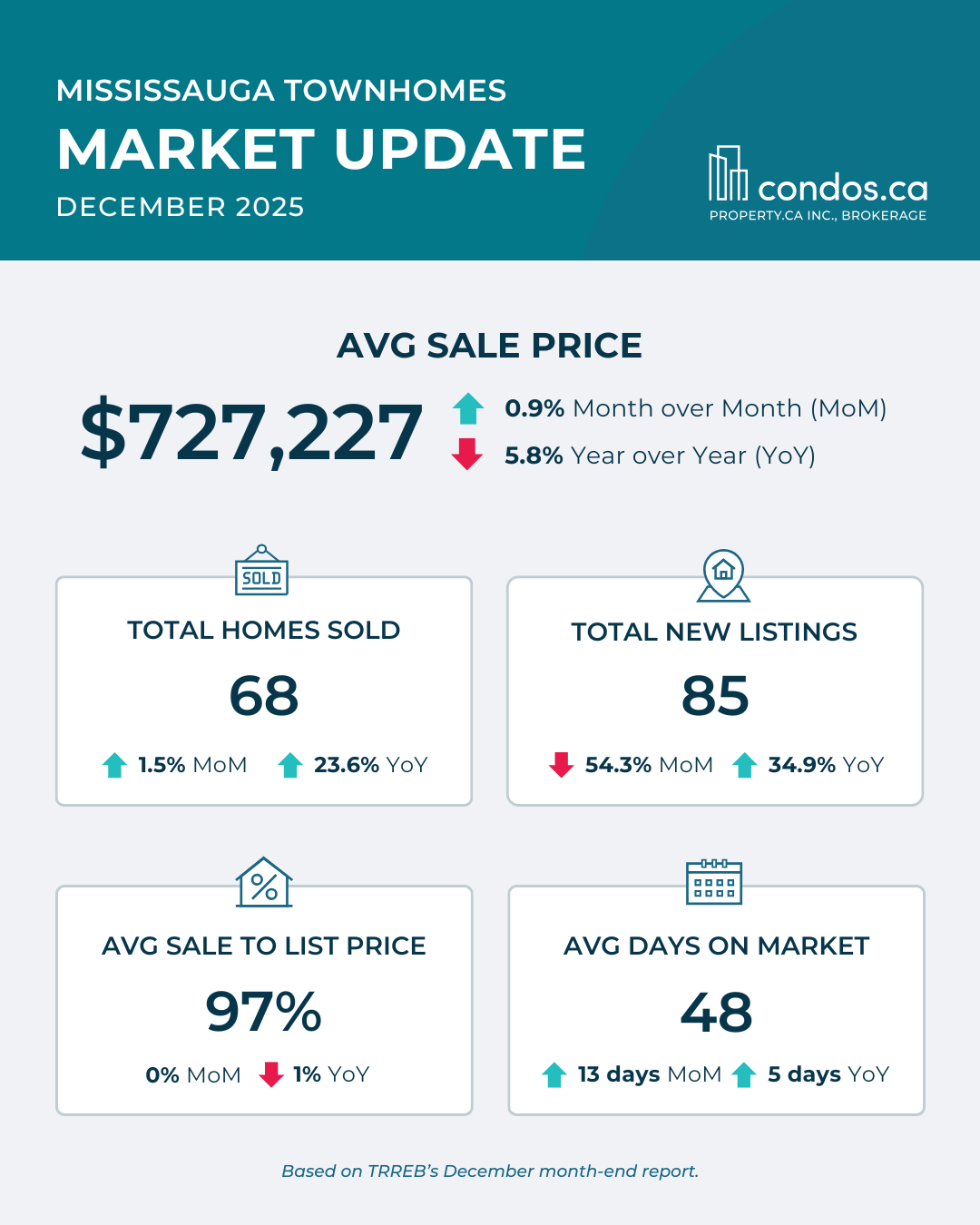

Detached homes continued to hold up better than the rest of the market, especially in the 905 as usual, where end-user demand remains more stable. Townhomes showed mixed results depending on location and price point, with well-positioned listings still moving, but without urgency. Condos remained the softest segment. Condo sales were down roughly 20 percent year over year, and pricing pressure was still most visible in downtown investor-heavy stock, where days on market continue to stretch and buyers remain highly selective.

The notable shift is affordability. Lower prices and softer borrowing conditions improved qualification for many buyers in 2025, even as confidence lagged. Sellers, meanwhile, have become more realistic about pricing and timelines, creating conditions that are easier to work with as the year begins.

What’s been holding activity back isn’t just housing-specific. Much of 2025’s hesitation was driven by broader uncertainty. Ongoing geopolitical instability, a volatile global economy, and political risk south of the border have all weighed on consumer confidence. For many households, decisions around housing were delayed not because the numbers didn’t work, but because the future felt harder to read.

That backdrop hasn’t disappeared, but it has become more familiar to the market. Buyers and sellers are adjusting to uncertainty rather than waiting for it to resolve completely. That shift matters. Markets tend to move not when conditions are perfect, but when expectations stabilize and people feel they can plan again.

What to Watch

Confidence versus caution

Improved affordability on its own wasn’t enough to drive a rebound in 2025. Employment stability and broader economic confidence will determine when sidelined buyers begin to re-engage in early 2026.

Inventory and absorption

Supply remains healthy across the GTA. A pickup in absorption or shorter days on market in Q1 would be the earliest sign that demand is starting to respond to current pricing.

Rate stability

With recent rate cuts now reflected in renewals and pre-approvals, buyers are working within more predictable borrowing conditions as the year begins.